When a company gives some share of its profits to its shareholders, it is called dividend. In this article you are going to get complete information about “Dividend Meaning”. If you invest in stocks in the stock market, the company will provide you some share of its profits annually on your invested amount. The amount of dividend the company will give to its shareholders is decided by the company’s board of directors. Let us know the process of dividend in complete detail.

What is the dividend in share market?

If you have invested in the stock market in a company whose financial condition is good and the company has been profitable for a long time, then you will get dividend on your invested amount. It is obvious that only a company which is making profit can give dividend.

Dividend is paid to you directly in your bank account by the company quarterly, half yearly or annually. You do not have to do any form or any process for dividend. The company itself does the process of paying dividends and the shareholders do not need to do anything.

By investing in dividend giving stocks, income also increases and you keep getting profits due to increase in share prices. Not all companies in the stock market pay dividends. Most people above 45 years of age like to invest in dividend stocks because if the company is good then it will keep giving you fixed income annually.

How are dividends distributed by the company?

When the company’s quarterly and annual results come and the company makes good profits, then the company earmarks a portion which is distributed as dividend to the shareholders. Suppose you have 500 shares of a company and that company declares a dividend of Rs 2 per share, then you will get a dividend of Rs 1000.

That means you can multiply the number of your shares by the amount of dividend. Similarly, the more shares he has, the more profit he will get per share. Dividends are paid to you by the company quarterly, half yearly or annually.

What is Dividend Yield and where to see it?

Dividend yield shows what percentage of dividend the company can give you annually in proportion to the stock price. The dividend yield of each stock varies according to its potential.

Dividend Yield Formula: Dividend yield= Annual Dividends Per Share / Current Share price * 100

Suppose the share price of a company is Rs 100 and it is going to give a dividend of Rs 1 per share, then the dividend yield of that company will be 1%.

You can use the Moneycontrol website to see the dividend yield of any company. You can get complete information about the company by searching there by entering its name. For more information you can read our fundamental analysis article.

Keep these things in mind for dividend

- It only depends on the company how much dividend it will give to its shareholders.

- Dividend yield can be increased or decreased by the company.

- If the financial condition of the company worsens or the company is running in loss, then the dividend can also be stopped.

- To get dividend, it is important that you invest in a good company which has no debt and has good financial condition and future.

- It is not necessary that the amount of dividend you are getting today will always be there.

- If the dividend is coming directly into your account, you will have to pay tax on it as per the slab.

- Advantages of dividend paying stocks

Help in increasing income: If you invest in a stock which gives annual dividend and the future of the stock is also good, then it will also help in increasing your income. Senior citizens mostly invest in dividend yielding stocks. In a way, you keep getting fixed income in your bank account in the form of dividends.

Increase in investment: Suppose you have invested one lakh rupees in a dividend giving stock and that stock also gives annual dividend and its share price also keeps increasing in the long run, then you will not only enjoy the dividend but also the amount of investment will also increase. That means you are going to get benefit in both ways. If you invest in stocks at a cheaper price, you can get higher returns.

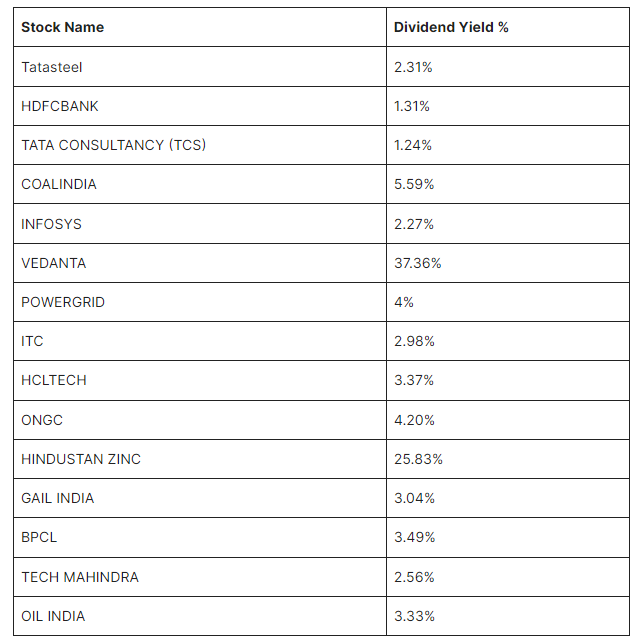

Top 15 Dividend Paying Stocks 2024 | List of Dividend Paying Companies

Above you can see dividend paying companies. As we told you earlier also, when the dividend will be received, how much will be received and whether it will be received or not, it all depends on the company. Everything keeps changing with time. You may be attracted by high dividend paying stocks but do not get lured by the dividend alone without research and without any expert advice.

Nice Blog with good Information