How to Learn Options Trading for Beginners Step By Step Information

If you want to do option trading then you will also have this question in your mind that “How do beginners learn option trading”. Through this article, we will tell you in very simple language how you can start option trading. Before getting into option trading, you should know that you want to do such trading where the risk will be high and the reward will also be high.

Before starting in option trading, you should know that there is a lot of risk in this trading. Option trading becomes very easy for those who are not afraid of taking risks and can withstand the ups and downs of the market. We are going to tell you some methods with the help of which you will be able to start in option trading.

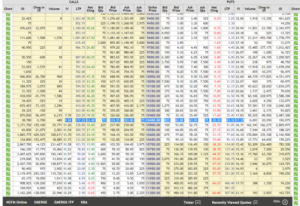

Information about Option Chain

Option chain plays an important role in option trading. Without this knowledge it is not possible to do option trading. Beginners should gain knowledge of option chain. With the help of Option Chain, you can see the data of Call and Put, Open Interest, Implied Volatility, Volume, and what is the price (LTP) of which strike price. Along with this, you get to know about the strike price like OTM, ITM, ATM prices from the option chain.

- Call and Put Data

- Open Interest

- Implied Volatility (IV)

- Strike Price (ITM, ATM, OTM)

- LTP (Last Traded Price)

- Volume

- Change In OI

You get to see all this data from Option Chain. Using this data makes your options trading easier. You can easily view the option chain on the NSE website and in your broker terminal.

Option Expiry Information

In option trading, it is important for you to know about option expiry. There are two types of expiry in options: weekly and monthly. That means, whatever strike price you buy in the option, you will also get its expiry. Some selected strike prices become zero on the expiry day. Monthly expiry occurs on the last Thursday of every month. That is, for example, if you create a position for monthly expiry on one date of any month, then your option will expire on the last Thursday.

Information about Option Greeks

Option Greeks play an important role in options trading. In Option Greeks you should know about Theta, Delta, Vega, Rho and Gamma. Only two things are more important for you, theta and delta. Within options trading, theta decay works to eat away the premium. Delta tells you how much your premium will increase if the index increases by fifty points. Theta is not a good thing for an option buyer but theta is a very interesting thing for an option seller. You should learn about option Greeks.

Understand Option Buying and Option Selling

It would be better if you first understand what is the difference between option buying and option selling. If you want to become an option buyer then you have to pay a premium to buy the strike price and your maximum loss can be only the premium paid and there is no limit on the maximum profit. But if you want to become an option seller then you will receive premium.

If the option seller sells an option at Rs 100, his maximum profit can be only Rs 100, but there is no limit on the loss. It takes less money for option buying and more than Rs 1 lakh for option selling. Now deciding whether you want to be an option buyer or option seller is also important for option trading. Both have their advantages and disadvantages.

Important role of choosing expiry, open interest and strike

Only three things can improve your options trading: option expiry, strike price selection and open interest. Beginners end up incurring losses due to lack of knowledge of these three things. In option trading, people buy OTM strike price in search of cheapness and when the market does not move in their direction, their premium starts decreasing.

You need to know what strike price you should work with. Along with this, newbies also get into trouble due to option expiry and lack of knowledge about options. You have to gain more and more knowledge and experience only then you will be able to succeed in options trading.

Choose the right option trading strategy

In option trading, there are different trading strategies for option buying and option selling. If you want to become an option buyer then you will have to work on momentum strategy. And if you want to become an option seller then you will have to work on a strategy where the market remains in a range. Choosing the right strategy is the most difficult task in option trading but they say that everything comes from experience.

In such a situation, both loss and gain are more. In high volatility, both the option buyer and seller have to act carefully. So you should also get information about volatility before getting into option trading. You can see the chart of India Vix by searching on Google.

It is important to learn risk management

Do you know that most of the people who make losses in options trading do so because they do not manage their risks? It is difficult to manage risk in option trading because sometimes even if the market moves in your direction, your premium does not increase and you suffer a loss. Therefore, it is not in our control when the option premiums calm down and when they start rising. Only our risk is under our control. You will be trading options with a calculated risk.

Know about High Volatility

If you want to learn options and you do not know about volatility, you may get into trouble. When there is high market volatility, option premiums rise and fall rapidly. For this you can see India vixs. When India Vicks remains between 10 to 15 then everything remains normal. But if India Vicks rises to 20 or more, premiums become expensive due to higher volatility

Pingback: Learn Crypto Option Trading - Unlock New Financial Opportunities | StockBazzar